April 6, 2020

CORONAVIRUS IMPACT:

Payment Trends; Building a New Patient Pipeline

In just a few short weeks, our nation has transformed from a booming economy into fears of extreme unemployment and a deep recession. Some of us lived through the assassination of JFK, the Challenger explosion, 9/11 and the Great Recession of 2008. There is no doubt that the coronavirus impact is perhaps the most significant event in our lifetimes.

In a previous memo, we discussed making slow, calculated changes in operating procedures rather than sudden, sweeping changes. Making calculated adjustments based on market trends is the wise approach when dealing with this crisis.

Payment Trends

Based on our data of almost 400,000 currently active responsible parties, we have noted the following payment trends:

Payment volume is still strong and running at normal levels.

- Payment failures are within the range of last year with no significant increase.

- Payment failure reasons are consistent with normal patterns.

- Call volume in our customer care center is actually down.

- This is contrary to what we anticipated.

- This may indicate that your responsible billing parties remain employed and financially stable for the moment.

- Less than ½ of 1 percent of responsible parties have asked for payment deferrals.

Responsible Party Feedback

- Many responsible parties want to rearrange their payment plan rather than defer payments.

- Some responsible parties are asking to temporarily reduce their monthly payment instead of deferring a payment.

Observations

- A few offices refuse to allow payment deferrals. In many cases, when the responsible asked for a deferral and are told a deferral is not an option, they elect to cancel the payment plan (their right under financial institution regulations).

- Some responsible parties ask to temporarily reduce their monthly payment rather than defer their payment.

- The best financial outcomes are going to offices who are the most flexible and compassionate.

- We believe that the financial picture is going to change for Americans over the next few weeks. As this change occurs and as we learn more about how to adjust, we will update you, keeping you informed of what we see and how we are responding on your behalf to help you be successful during this very challenging time.

OrthoBanc Recommendation and Protocol Change

It is always better to successfully collect as much of your accounts receivable as possible. When a responsible party asks to temporarily reduce their payment amount instead of deferring a payment, we recommend you allow the change in payment amount.

Effective immediately, based on what we are hearing from the responsible billing parties that have contacted us, OrthoBanc will make a slight shift to its protocol. When a patient asks to defer a payment, we will begin that conversation by offering a payment amount reduction of up to 50% for the upcoming payment only. If this doesn’t work for the responsible party, we will offer to defer one payment (only) to the end of the contract without reaching out to you for approval. If the responsible billing party requests to defer more than one payment, we will contact you for guidance. (Please note, the only adjustment we have made to our current protocol is that we will first ask the responsible party to reduce their payment amount rather than deferring the payment.)

If you have any questions concerning how we are managing your payments, please reach out to COVIDProtocol@orthobanc.com. Again, we are making small, calculated adjustments based upon feedback from the market.

Notifications of Our Actions

If our customer care team defers a payment or reduces a payment amount, you are notified on our Weekly Recap Report in the Notice To Practice section. Please refer to the real-time Weekly Recap Report that is available on our website to learn of adjustments we have made.

New Patient Pipeline

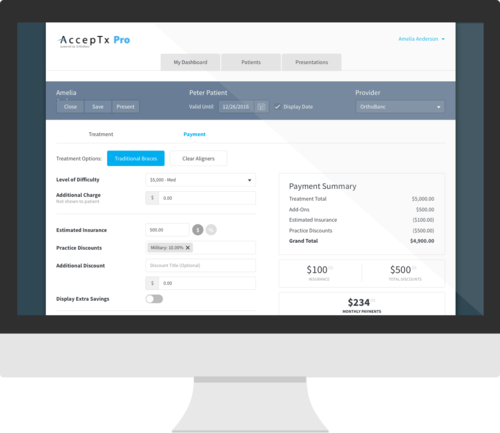

The number of new patient accounts OrthoBanc receives has dropped from nearly 1,000 each day to below 100. It is surprising this number is not lower. However, several practices are taking advantage of AccepTx Pro, our treatment and fee presentation tool that can be easily viewed by the responsible party from home.

By combining a teledentistry diagnosis with AccepTx Pro’s elegant in-home presentation, practices are still building a new patient pipeline that will help fill chairs once the “stay-at-home” measures are lifted. Responsible parties can view your treatment recommendations, design a payment plan that fits their budget, and accept and sign all necessary forms from the comfort of home. You build a pipeline of business that will help your practice recover as soon as you can reopen your doors.

If you want to learn more about AccepTx Pro, our team stands ready to review its benefits with you and get you set up to start building that pipeline. We can even help you locate a teledentistry solution. Call us at (888) 758-0585, option 2, and ask about our special offer on AccepTx Pro.

Please be safe during this time. Perhaps in a few more weeks, we will be returning to normal.

Bill Holt

OrthoBanc’s President/CEO

bholt@orthobanc.com